Frequently Asked Questions

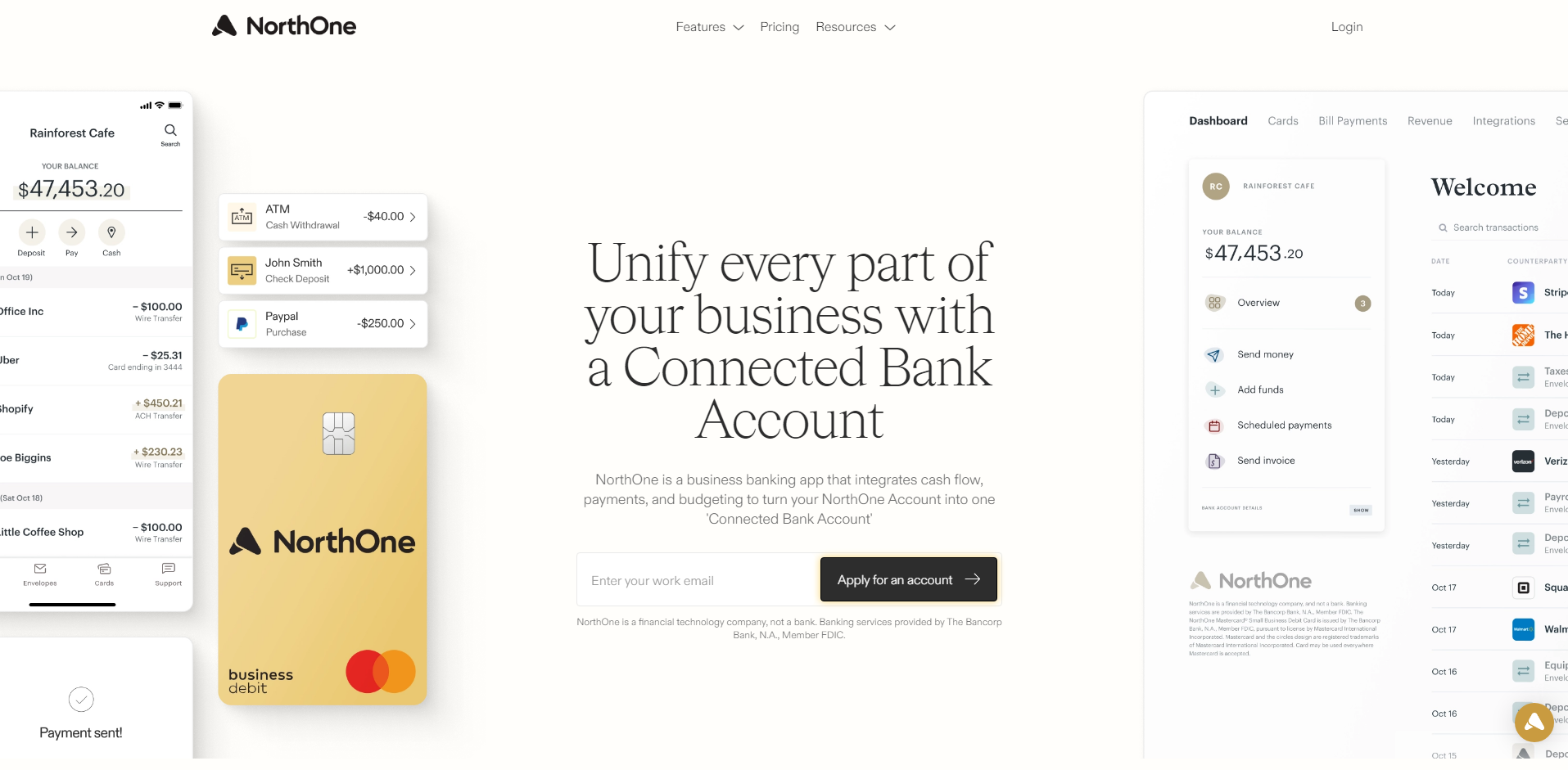

Banks for startups, unlike conventional banks, cater specifically to the unique needs of emerging businesses. They offer specialized services such as seed funding, venture capital, easy business account setup, and flexible loan options.

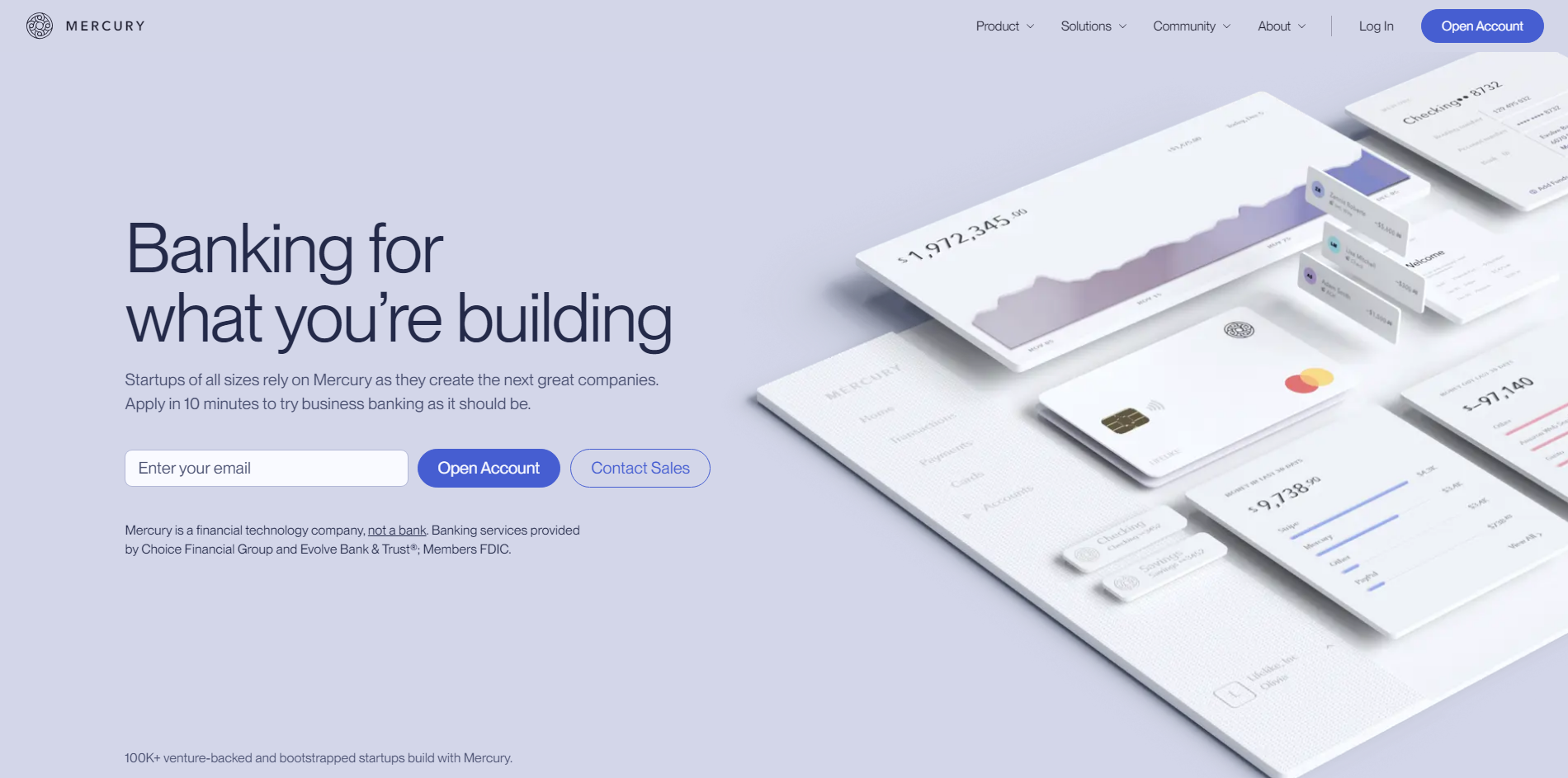

These startup-focused banks often integrate with digital tools and platforms commonly used by startups, offering a seamless banking experience that fosters growth and innovation.

Comparatively, traditional banks may not provide the same level of tailored support or technological integration for new businesses.

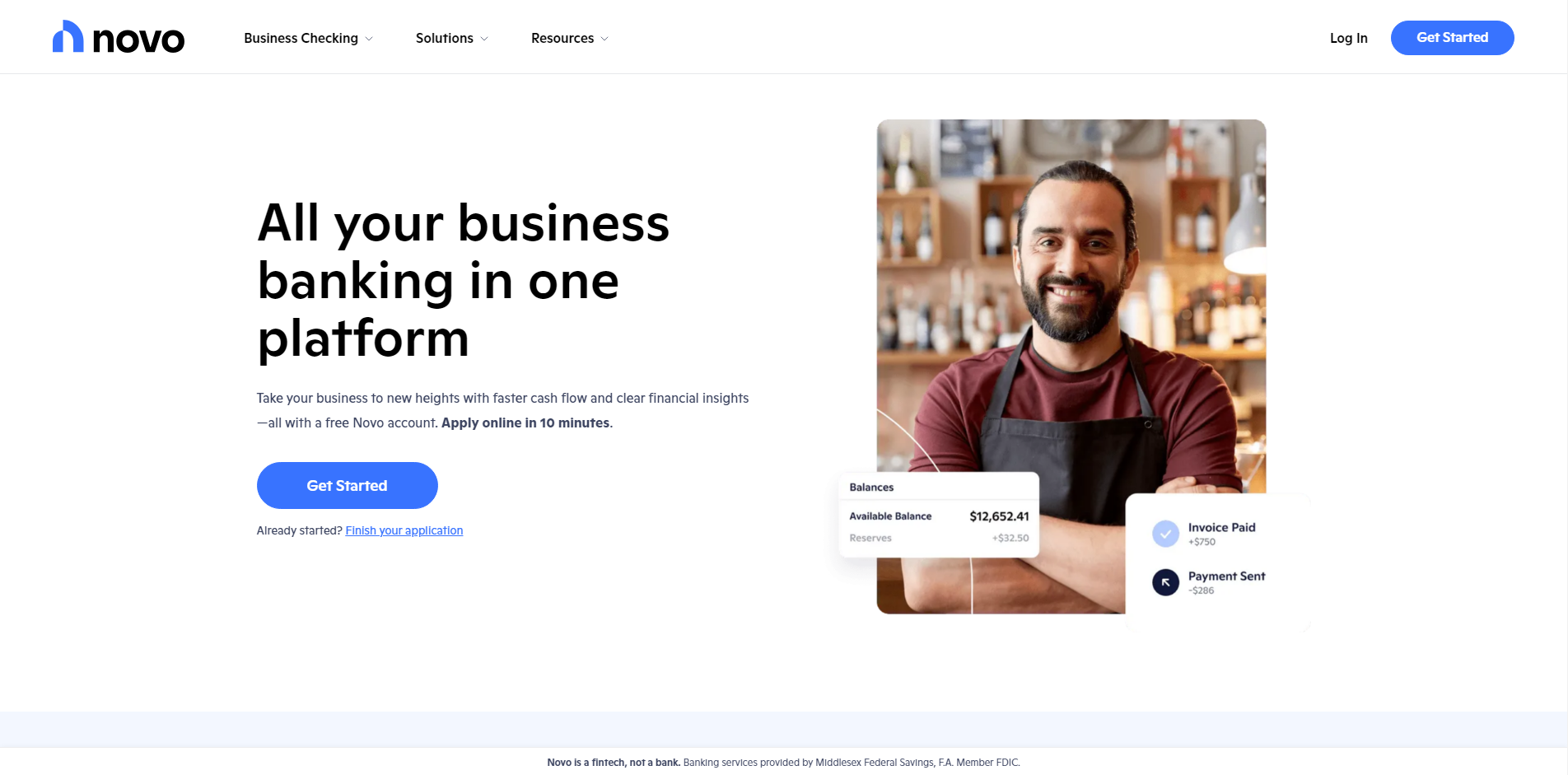

Startups typically require a variety of banking services such as business checking accounts for managing daily transactions, credit cards for financing and building credit history, and business loans for capital infusion.

Additionally, they may need services like payroll management, wire transfers, and online banking for seamless financial operations.

It's integral to choose a bank that understands startups' unique needs and offers scalable solutions.

Choosing a bank specifically designed for startups brings numerous benefits. Such banks often offer tailored financial products and services that cater to the unique needs of startups, such as low-fee accounts, flexible lending options, and startup-friendly credit facilities.

They also provide invaluable financial advice and support, which can greatly aid in navigating the complex financial landscape of a burgeoning business.

Lastly, these banks understand the startup ecosystem and its inherent risks, making them better positioned to offer suitable solutions.

Banking with a startup-focused bank might come with a few potential drawbacks. They may not offer the breadth of services that traditional banks provide, limiting your financial management options.

As relatively newer entrants to the banking sector, they may lack the robust support systems and infrastructure of established banks.

Additionally, their focus on startups could mean they lack expertise in other business areas, which could limit their ability to provide comprehensive financial advice.

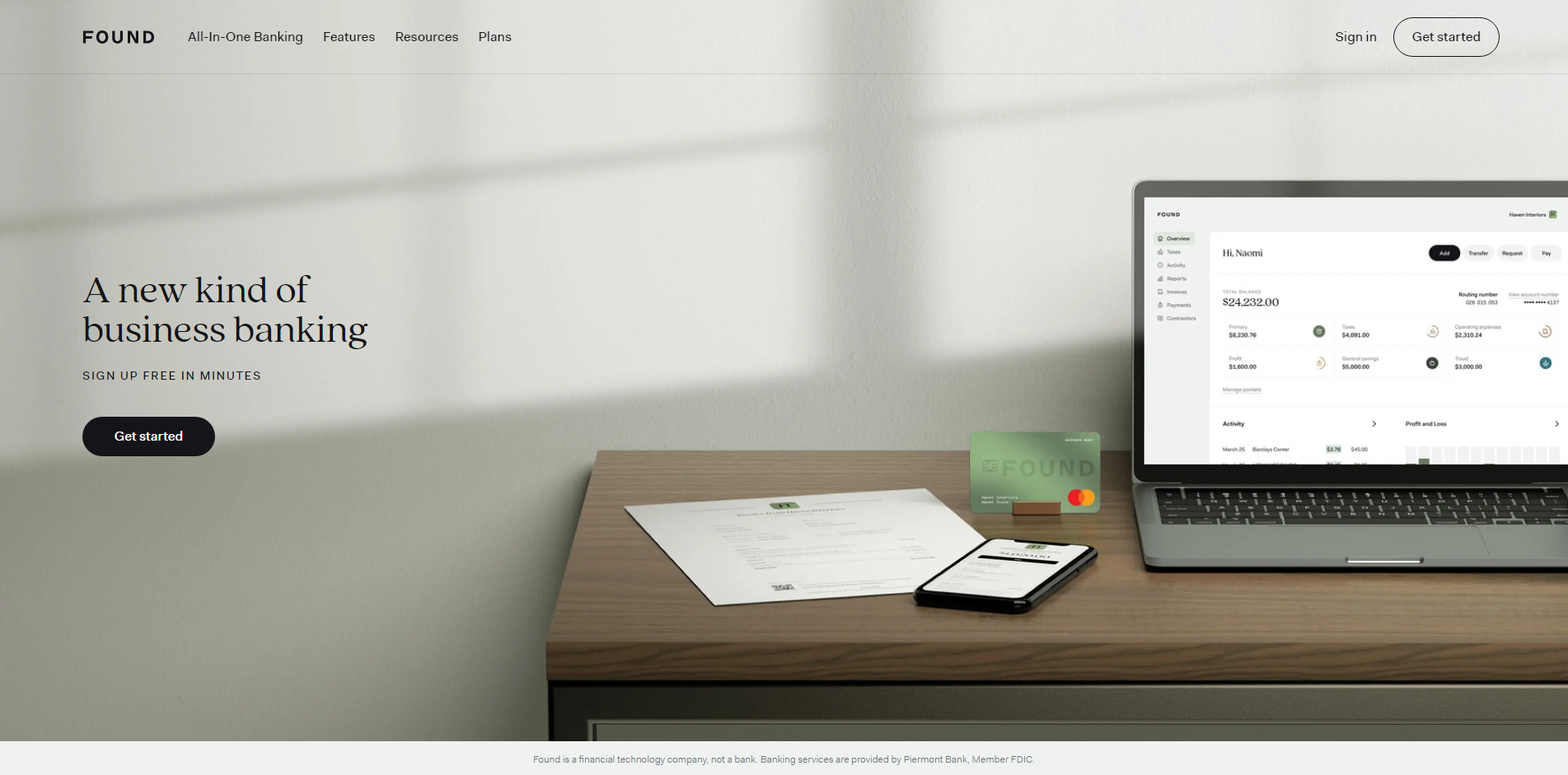

A startup bank provides specialized financial services designed to support the unique needs of emerging businesses.

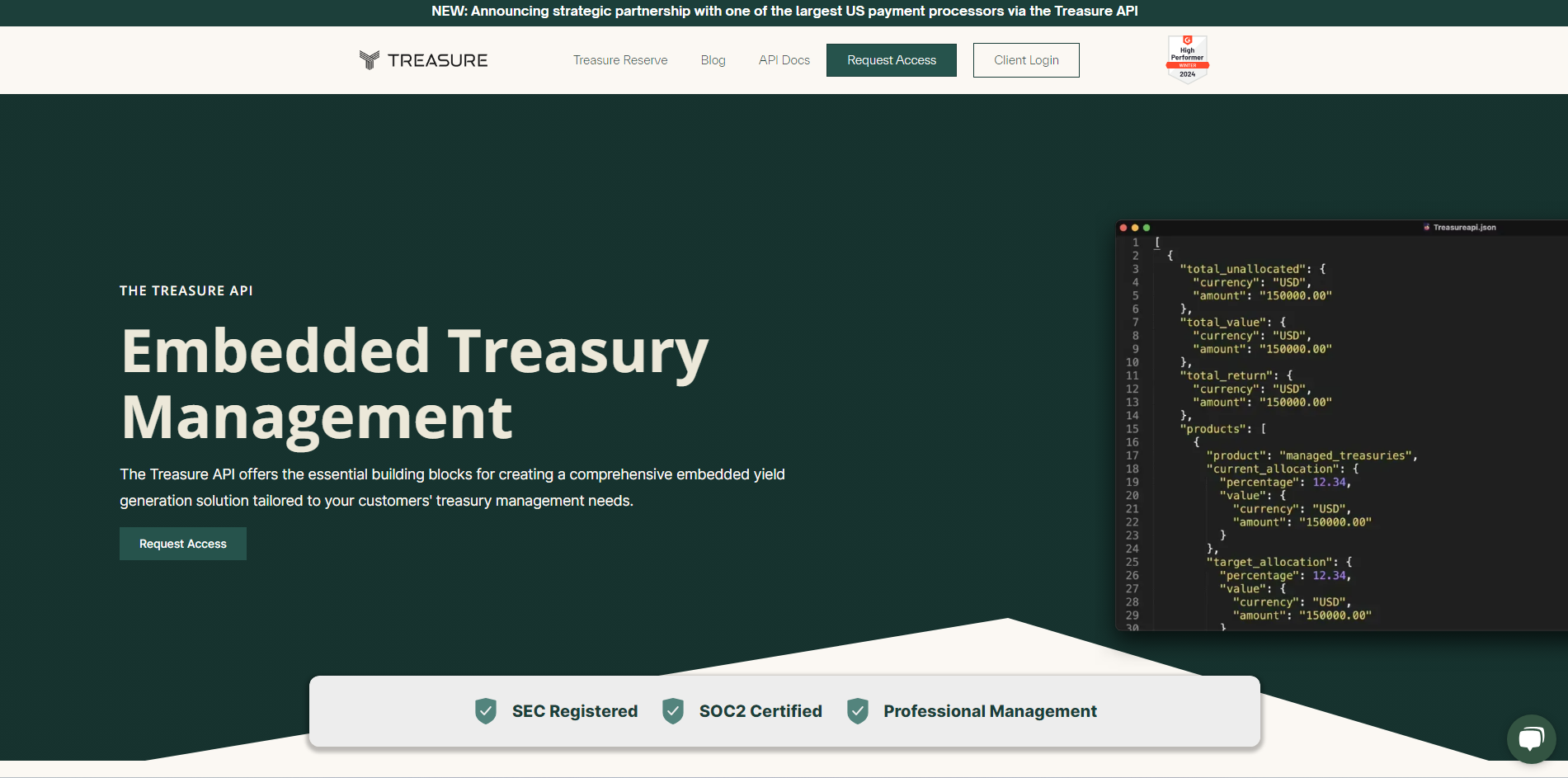

They offer features like easy account setup, lower fees, and seamless integration with financial tech apps which can simplify expense tracking and cash flow management.

Additionally, some startup banks provide access to networks of investors and other startups, facilitating essential growth opportunities.

These benefits help startups streamline their financial management, enabling them to focus more on their core business operations.

Startups should seek a bank that offers features tailored to their unique needs. These should include:

- Easy online banking

- Low fees

- Business credit cards with reward programs

- Strong customer service

Additionally, access to small business loans or lines of credit can be invaluable for a growing startup. It's also beneficial to find a bank that understands and caters to the startup ecosystem with specialized products or services.

Yes, many startup banks offer financial advice and guidance as part of their services. These banks understand the unique challenges startups face, such as cash flow management and funding issues. They provide tailored advice to help startups navigate these complexities, often with dedicated business specialists or through digital tools and resources.

However, the level and type of advice offered can vary between banks, so it's crucial for startups to compare options and choose a bank that best suits their specific needs.

Startup banks typically streamline the account opening process online, making it fast and efficient. The process involves providing business information such as the startup's legal name, tax ID, and address. Some banks may require additional documentation like articles of incorporation.

After the application is reviewed and approved, the bank usually offers access to various banking features tailored for startups, such as digital banking, transaction monitoring, and integrated accounting tools.

Startup banks often charge fees including monthly service fees, transaction fees, and ATM withdrawal fees. Some may also levy charges for wire transfers, overdrafts, and issuing checks.

However, many startup banks offer fee-free banking for a certain period or up to a specific transaction volume to attract new businesses.

Remember, fee structures vary widely between institutions, so it's essential for startups to compare and contrast these costs when choosing a startup bank.

Startup banks, also known as neobanks, handle international transactions through modern fintech platforms, often offering lower fees and real-time exchange rates.

Many of these digital banks offer multi-currency accounts, making it easier for startups to do business globally.

However, the speed and cost of international transactions can vary, so it's essential to compare different startup banks to find the most efficient and cost-effective option for your business needs.

Startup banks, often referred to as challenger or neobanks, are generally secure and regulated just like traditional banks. These digital-first financial institutions are typically regulated by the same local financial authority that oversees established banks, ensuring they adhere to industry standards for security and customer protection. However, it's always prudent for startups to verify the regulatory status and security measures of any bank they're considering.

Startup banks, specially designed to cater to new businesses, play a crucial role in fostering growth and development. Offering tailored services like low-cost transactions, easy-to-use digital platforms and dedicated business advice, they help startups streamline their financial management, reducing overhead and freeing up resources.

Additionally, these banks often provide access to funding opportunities, including loans and venture capital, which can be vital for business expansion. Hence, a startup bank can be a key partner in a new business's journey towards success.